Social security for dummies cheat sheet

Table of Contents

Table of Contents

Are you nearing retirement and wondering how much social security can i draw? It’s a common concern for many Americans, and rightfully so. Social security benefits can make up a significant portion of your retirement income. In this article, we will explore everything you need to know about how much social security can i draw and related keywords. Read on to find out more.

Potential Pain Points

Retirement planning can be overwhelming, especially when trying to determine how much social security you can draw. Without understanding how the system works, it is easy to fall into common misconceptions that could lead to financial struggles later in life. Additionally, you may worry that social security benefits will not be enough to support your expected retirement lifestyle or that they will not be available at all when you retire.

How Much Social Security Can I Draw?

Your social security benefits are determined by a few factors including your earnings record, age of retirement, and number of years you worked. To get an estimate of your benefits, you can use the Social Security Administration’s online calculator. Generally, you’ll receive the highest benefit amount if you retire at full retirement age, which is 66 for those born between 1943 and 1954. However, you can start receiving benefits as early as age 62 or wait until as late as age 70 to increase your monthly benefit amount.

Main Points to Consider

When planning for retirement, it’s important to consider how much social security you can draw and how it fits into your overall financial plan. Keep in mind that social security benefits will likely only replace about 40% of your pre-retirement income, so it’s essential to have other sources of retirement income, such as personal savings or a pension. It’s also important to remember that the longer you delay taking social security, the higher your benefit amount will be.

Personal Experience

When planning for retirement, I was unsure of how much social security I would receive and how it would affect my overall retirement income. I used the Social Security Administration’s online calculator to estimate my benefits and found it to be a helpful tool. It gave me a clear idea of what to expect and helped me incorporate social security benefits into my overall retirement plan.

Common Misconceptions

One common misconception surrounding social security benefits is that they will be enough to support a comfortable retirement lifestyle. While benefits can help, they should not be relied on as the sole source of retirement income. Another misconception is that social security benefits will not be available when you retire. However, while the system may face funding challenges in the future, it is unlikely that benefits will disappear entirely.

Factors Affecting Benefit Amounts

As mentioned, your social security benefits are based on your earnings record, age of retirement, and number of years worked. Additionally, the amount you receive may be affected by a variety of factors such as past and current marital status, government pensions, and work performed outside of social security-covered employment.

Understanding Your Benefits

To ensure you are making the most of your social security benefits, it’s important to understand how they work and how to maximize your benefit amount. One way to do this is to delay taking benefits until your full retirement age or even later. Additionally, you should consider your spouse’s benefits and how to coordinate your retirements to maximize your combined benefits.

Question and Answer

Q: Can I receive social security benefits even if I never worked?

A: It depends. You may be eligible for benefits based on your spouse’s work record or as a survivor of a deceased spouse.

Q: How do I know what my full retirement age is?

A: Your full retirement age depends on your date of birth. You can find a full list of retirement ages on the Social Security Administration’s website.

Q: Can I still work and receive social security benefits?

A: Yes, but if you have not yet reached full retirement age, your benefits may be reduced if you earn above a certain limit. Once you reach full retirement age, your benefits will not be reduced, regardless of your income.

Q: What happens if social security runs out of money?

A: It is unlikely that social security benefits will disappear entirely. However, if the system faced funding challenges, benefit amounts could be reduced or changes could be made to the system to ensure its longevity.

Conclusion of How Much Social Security Can I Draw

As you plan for retirement, it’s important to understand how much social security you can draw and how it fits into your overall financial plan. By using the Social Security Administration’s online calculator, delaying taking benefits until your full retirement age, and coordinating your retirements with your spouse, you can maximize your benefit amount and support a comfortable retirement lifestyle.

Gallery

How Much Social Security Will I Draw At 66

Photo Credit by: bing.com / retirement retire years

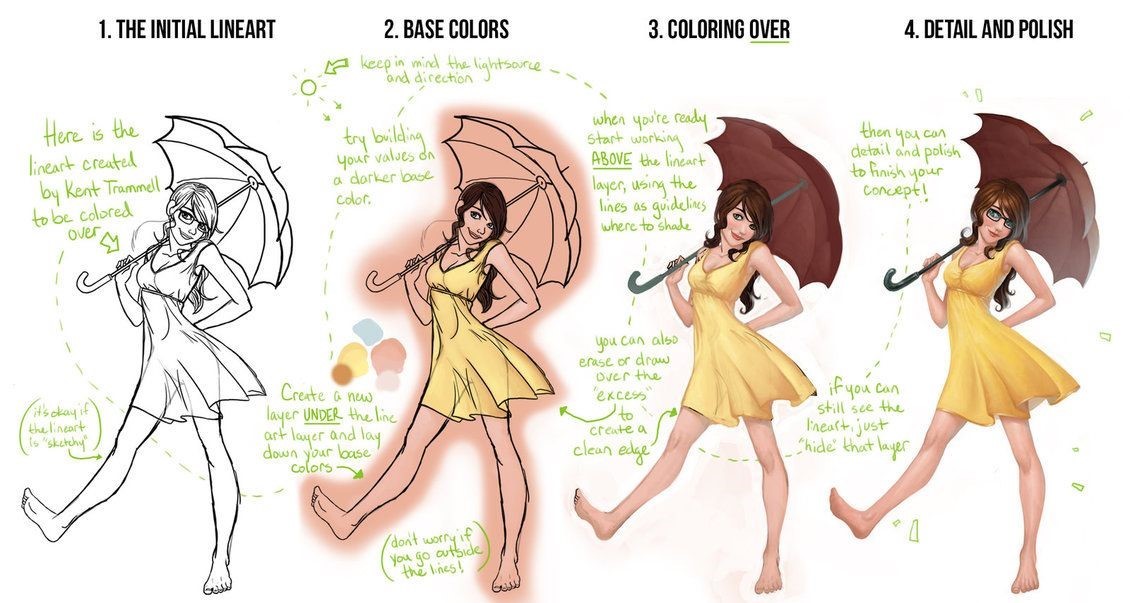

How Much Social Security Will I Draw At Age 62

Photo Credit by: bing.com / security mateo

How Much Social Security Will I Draw At Age 62

Photo Credit by: bing.com /

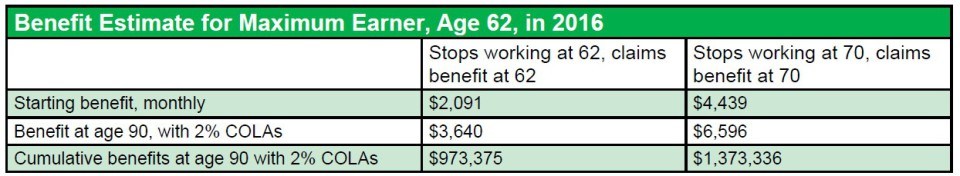

Social Security For Dummies Cheat Sheet - Dummies

Photo Credit by: bing.com / dummies security social sheet cheat

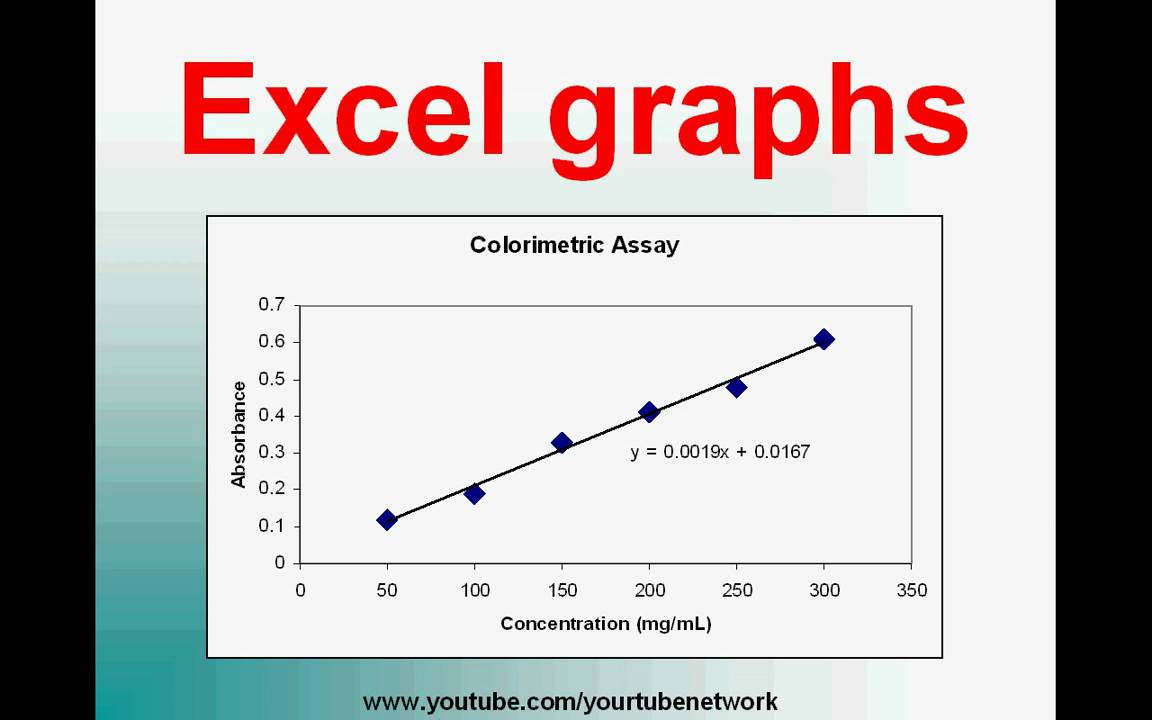

Exactly How Much Social Security Can You Count On – MillionairWax

Photo Credit by: bing.com / axios